Companies Act Compliance

Manage company incorporation, governance, and ROC filings under the Companies Act, 2013. Entries.ai automates board meeting disclosures, MCA reporting, and compliance deadlines with built-in document management tools

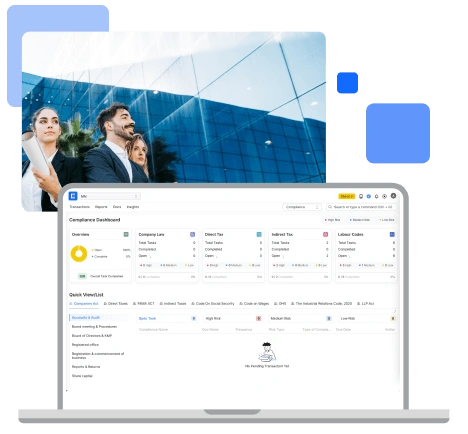

Stay Ahead of Regulatory Risks with Smart HR, Tax, and Labour Law Compliance

Entries.ai’s AI-driven compliance software simplifies legal, HR compliance, and financial regulations through a dynamic risk- and task-based system. Designed for startups and fast-scaling companies in India, it automates everything from labour law compliance to e-TDS tracking — ensuring you're audit-ready, always. Say goodbye to fragmented tools and stay on top of tax deadlines, HR compliance checklists, and regulatory filings — all in one dashboard

Monitor statutory, HR compliance, and labour law compliance in real-time with Entries.ai's intelligent compliance software. Get instant visibility into risk areas with an AI-powered dashboard that keeps your business audit-ready

Our AI compliance software prioritizes HR compliance, tax, and labour obligations based on risk-level and urgency. This ensures no deadlines slip through the cracks—especially in complex legal environments

Never miss a deadline again. Entries.ai’s calendar auto-tracks e-TDS compliance, GST filings, GST returns, IT Returns, Provident Fund, ESIC, Professional Tax, and other key statutory tasks—fully integrated with our compliance software and document management module

Securely store all your compliance software documents, including tax records, Form 16, payroll reports, HR contracts, and regulatory filings in one unified document management dashboard for faster audits

Get an AI-driven compliance score that evaluates your performance across TDS, tax filings, HR compliance, and statutory reporting. Proactively fix gaps before they become risks

Stay compliant with labour law mandates and HR regulations, including Provident Fund, ESIC, Gratuity, Bonus, Professional Tax, Labour Welfare Fund, and Minimum Wages — all tracked in a unified compliance software

Automate and track e-TDS, GST filings, GST Returns and IT Return filings with Entries.ai's smart tax compliance software. Reduce errors and avoid penalties with on-time regulatory submissions

Manage niche regulatory needs with ease — from SEBI and FSSAI filings to EHS compliance — all within one AI-powered compliance dashboard

Ensure environmental standards, employee safety laws, and workplace health norms are fully met through our built-in EHS compliance tracking tools

Stay on top of ROC compliance, director filings, and governance reports — all managed under a centralized system aligned with corporate law standards and integrated document management

Entries.ai is a unified compliance platform built for startups and growing businesses. We simplify accounting, payroll, HRM, and regulatory compliance—from Labour Welfare Fund compliance and e-TDS filings to ROC compliance, FEMA regulations, and industry-specific mandates like FSSAI, SEBI, and EHS. Our AI-powered tools automate statutory reporting, minimize errors, and help you stay audit-ready at all times

Manage company incorporation, governance, and ROC filings under the Companies Act, 2013. Entries.ai automates board meeting disclosures, MCA reporting, and compliance deadlines with built-in document management tools

Automate compliance with the Income Tax Act, 1961 — from e-TDS, advance tax, Form 16, IT return filings to real-time alerts and GST returns integration—everything simplified and automated on one compliance software

Ensure 100% compliance with India's labour codes covering Provident Fund, ESIC, minimum wages, gratuity, Professional Tax, and Labour Welfare Fund. Entries.ai streamlines payroll compliance and automates filings

Handle FEMA filings for cross-border transactions, foreign investments, and ECBs. Entries.ai automates RBI reporting, foreign remittance approvals, and FEMA documentation through centralized document management

Simplify your GST return filing, input tax credits, and e-TDS on GST. Our automation tools track every tax update and ensure seamless indirect tax (IT) compliance

Meet sector-specific needs like FSSAI for food, SEBI for finance, and EHS compliance for manufacturing. Entries.ai offers tailored tracking based on your industry