Accurate ITC Starts with

Accurate 2B Reconciliation

Entries.ai automates the entire GST 2B matching process — helping you claim the right ITC, detect mismatches and track non-compliant vendors.

Smart, Automated 2B Reconciliation

Auto Import GSTR-2B

Upload JSON and get instant processing.

Smart Matching Engine

Deep matching across

-

Vendor GSTIN

-

Invoice number

-

Date

-

Tax amounts

-

Item values

Mismatch Detection

See exactly where things differ

-

Qty/Rate mismatch

-

Missing invoices

-

Extra invoices

-

Vendor mismatch

-

Amendments

Vendor Compliance Tracking

Assess your vendor's GST behavior.

-

Compliance score

-

Pending documents

-

Repeated mismatches

-

Monthly summaries

ITC Posting to Accounts

Finalized credits move automatically to your books.

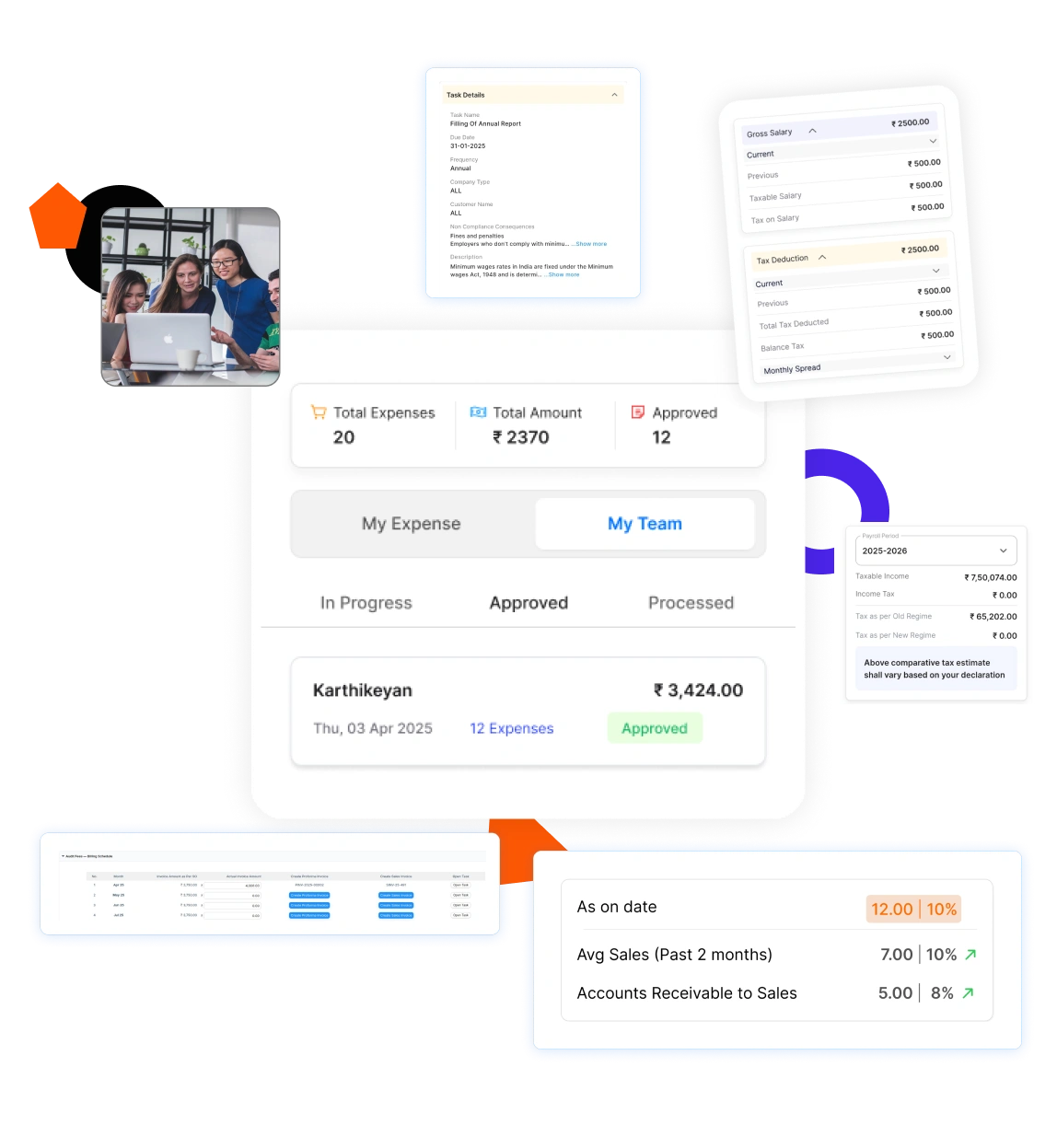

Why Entries AI

Revolutionize Startup Business with Entries AI Unified Application & Expert Services

-

Compliance + Documents unified

-

Completely structured and audit-ready

-

Built for Indian regulatory needs

-

Zero filing gaps, zero missing proofs

-

Mobile + desktop access

Frequently

Asked

Questions.

Entries.ai is a powerful accounting software designed for startups and mid-sized companies. It integrates bookkeeping software, expense management, payroll, and compliance into one cloud accounting software platform—delivering enterprise-grade features at a startup-friendly price point

Our platform automates payroll and integrates seamlessly with expense management and accounts payable, reducing manual effort and improving accuracy. With one unified dashboard, finance teams can manage everything from salary disbursements to statutory deductions with ease.

Absolutely. Entries.ai functions as a complete GST accounting software and includes built-in e-invoicing software for automated invoice generation. You can also use our online invoicing software to send compliant invoices, track payments, and manage accounts receivable effectively.

Our system includes robust purchase order management features, allowing users to create, approve, and track purchase orders in real time. You can also generate and send sales quotations directly from the platform to streamline your sales pipeline.

Yes, Entries.ai enables instant migration from platforms like Tally and Zoho. Your accounting software data, including ledgers, payroll, and accounts payable/receivable history, is securely imported into our cloud accounting software with minimal disruption.

Bill of Materials (BOM) is a structured list of all components, materials, and operations required to manufacture a product. With Entries AI, you can build a comprehensive Bill Of Materials, define costs for each material, include scrap material mapping, and enforce quality control standards.

Reconcile Faster. Claim Correctly. Avoid Loss of ITC.

Simplify reconciliation, automate reporting, and ensure 100% accuracy through our input tax credit automation workflows—all with one intelligent, integrated app