Automated Compliance & Smart Document Management

Stay compliant across all Indian laws with automated tasks, organised statutory documents, evidence tracking, and audit-ready workflows — all in one place.

Compliance is complex when tasks, documents, and proofs are scattered

Entries brings everything together — a single system to track due dates, manage tasks, organise documents, and stay audit-ready across GST, TDS, PF/ESI, Income Tax, ROC, Labour and more.

Automated Compliance

Calendar

- Pre-built compliance map for all major Indian regulations

- Recurring tasks with reminders & SLAs

- Assign owners, reviewers, and approvers

- Status tracking from Not Started to Completed

- Covers GST, TDS, PF/ESI, PT, ROC, IT, Labour Laws & more

Auto-Organised Documents

(FY →

Month

→ Law)

- Automatically created folders for each financial year

- Month-wise segregation for every compliance category

- Upload challans, returns & working papers from web/mobile

- Documents auto-linked to the correct compliance task

- No more scattered files or missing proofs

Evidence

Management

- Pre-built compliance map for all major Indian regulations

- Recurring tasks with reminders & SLAs

- Assign owners, reviewers, and approvers

- Status tracking from Not Started to Completed

- Covers GST, TDS, PF/ESI, PT, ROC, IT, Labour Laws & more

Workflow and

Approvals

- Maker → Checker → Approver flow

- Custom checklists & instructions for each compliance

- Notes, comments & activity log

- Escalations for delays & SLA breaches

- Ensures accuracy, clarity, and accountability

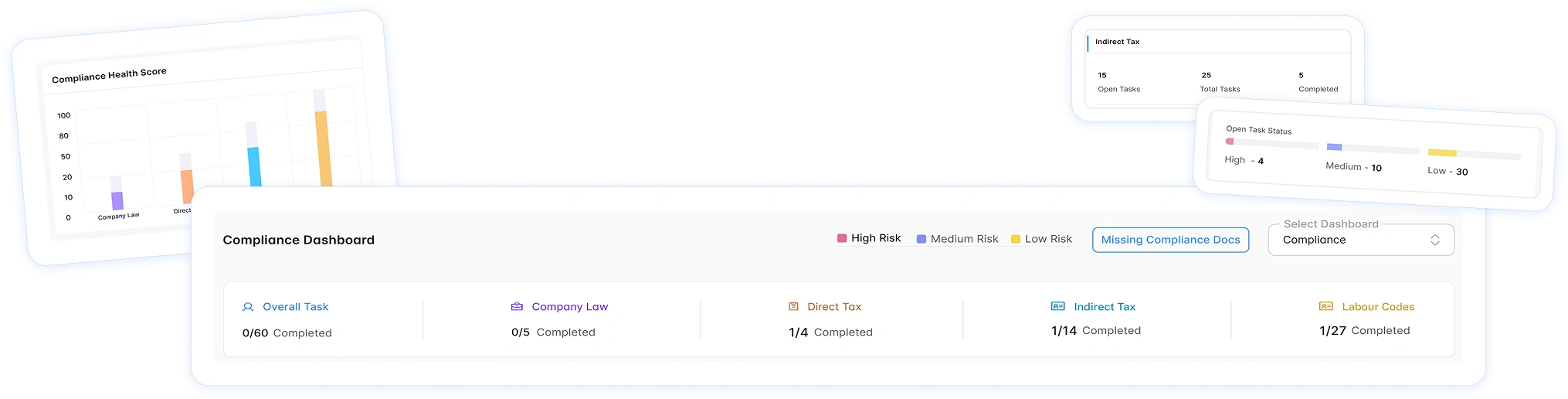

Compliance

Dashboard

- Upcoming & overdue compliances

- Entity-wise compliance score

- Law-wise compliance health

- Missing evidence and pending approvals

- Team workload visibility

Document

Control

- Centralised, secure document repository

- Tagging, search & filters

- License and certificate expiry alerts

- Document preview & controlled access

- Full document lifecycle visibility

Audit-Ready

Workflows

- Automatically compiled FY audit folders

- Evidence index and linked tasks

- Exportable compliance registers

- Read-only auditor access

- Faster, simpler, accurate audits

Who It's

For

- Startups & SMEs

- Manufacturing & multi-location businesses

- HR, Finance & Compliance teams

- Internal audit & legal teams

- CA/CS and outsourced compliance firms

Why Entries AI

Revolutionize Startup Business with Entries AI Unified Application & Expert Services

-

Compliance + Documents unified

-

Completely structured and audit-ready

-

Built for Indian regulatory needs

-

Zero filing gaps, zero missing proofs

-

Mobile + desktop access

Frequently

Asked

Questions.

Compliance software helps companies automate and manage regulatory requirements and internal policies so that the business stays compliant. This reduces the risk of penalties or crackdown from regulatory authorities due to non-compliance.

Any company that is subject to industry regulations, legal requirements, or internal governance policies requires compliance software. Compliance software is essential for all sectors—especially finance, healthcare, manufacturing, education, and IT.

Compliance software should typically include features like policy management, audit tracking, risk assessment, document management, real-time reporting dashboards, and automated alerts for regulatory deadlines such as GST Return, GST filing, IT returns, Professional Tax, e-TDS, and Form 16.

A robust compliance software maintains centralized records, audit trails, and supporting documents—streamlining both internal and external audits. It simplifies the preparation process and ensures compliance with HR regulations, IT Return protocols, and statutory requirements like Provident Fund and Professional Tax.

Yes. Entries.ai compliance software solution offers customizable workflows to align with specific frameworks such as GDPR, ISO 27001, HIPAA, SOX, or regional compliance needs like ESIC, Labor Welfare Fund, and GST Filing.

Our unified business platform follows enterprise-grade security protocols, including encryption, role-based access control, and secure cloud hosting—protecting sensitive HR and financial data like e-TDS, Form 16, Provident fund and IT Return records.

Work Smarter. Grow Faster

Simplify your operations with our unified bookkeeping software, advanced expense management, and real-time insights—all powered by Entries AI