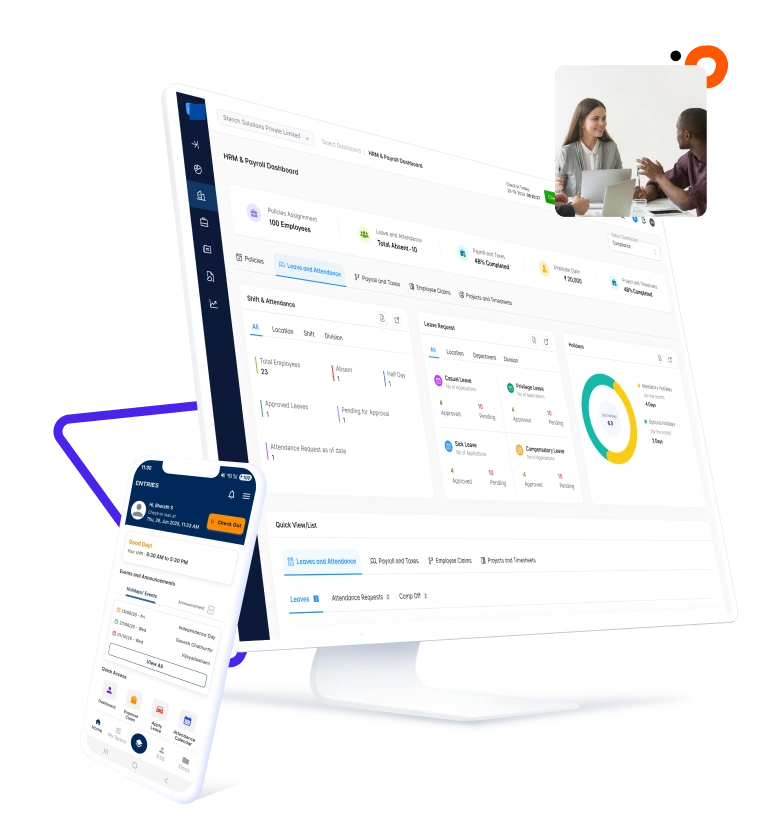

AI-Powered HRMS & Payroll Software for Indian Businesses

Run payroll in minutes and manage HRMS, attendance, leave and compliance (PF, ESI, PT, TDS) — across the entire hire-to-retire lifecycle.

Complete Hire-to-Retire HRMS Software

Entries HRMS & Payroll helps startups and growing companies manage people, payroll, and compliance without complexity. From recruitment and onboarding to performance, payroll, and exits—everything runs on one intelligent system.

Why teams choose Entries.ai

- Complete hire-to-retire coverage

- Payroll & compliance built for India

- AI-assisted workflows

- Enterprise-grade HR at startup pricing

Fast, Compliant Payroll Software and Employee Self-Service (ESS) for

Recruitment & ATS

Hire faster with a structured and collaborative recruitment workflow.

Manage job openings, candidates, and interviews from one place—no spreadsheets, no emails lost.

- Job requisitions & postings

- Candidate pipeline & stages

- Resume capture & screening

- Interview scheduling & feedback

- Offer management & tracking

Easy Employee Onboarding

Turn offers into productive employees—without paperwork chaos.

Digitize onboarding so new hires can complete everything before Day 1.

- Digital offer letters

- Document collection & verification

- Employee master creation

- Policy acknowledgements

- Role, department & payroll mapping

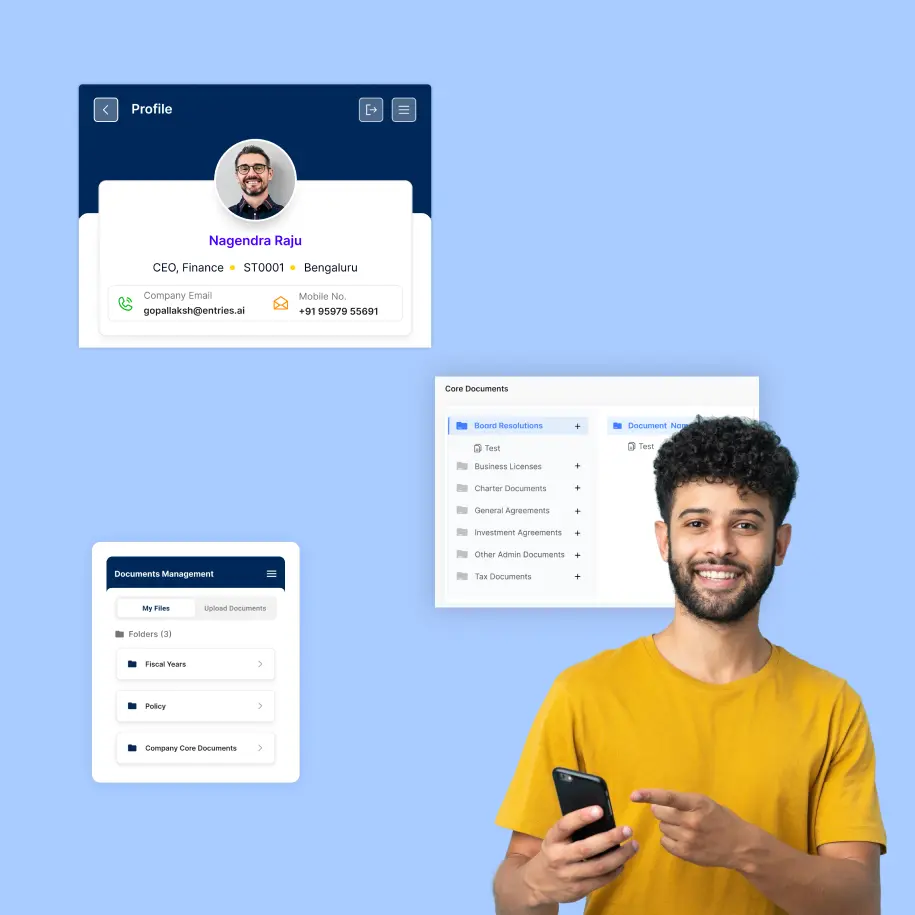

Core HR & Employee Management

A single source of truth for all employee data.

- Employee profiles & documents

- Department, role & reporting hierarchy

- Policies & announcements

- HR workflows & approvals

- Tasks, To-Dos, and Notifications

Employee Self-Service (ESS) - Mobile & Web

Empower employees with real-time access—no HR follow-ups needed.

- Leave applications & balances

- Attendance & timesheets

- Payslips & tax details

- Reimbursements & claims

- Mobile & desktop access

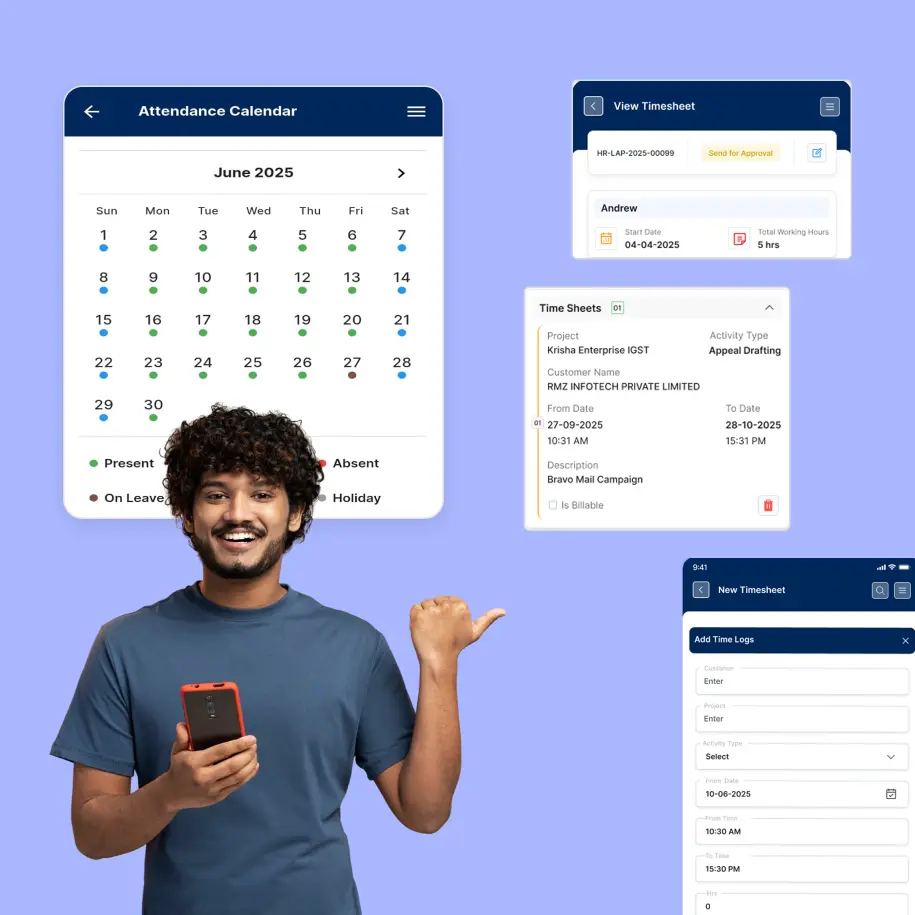

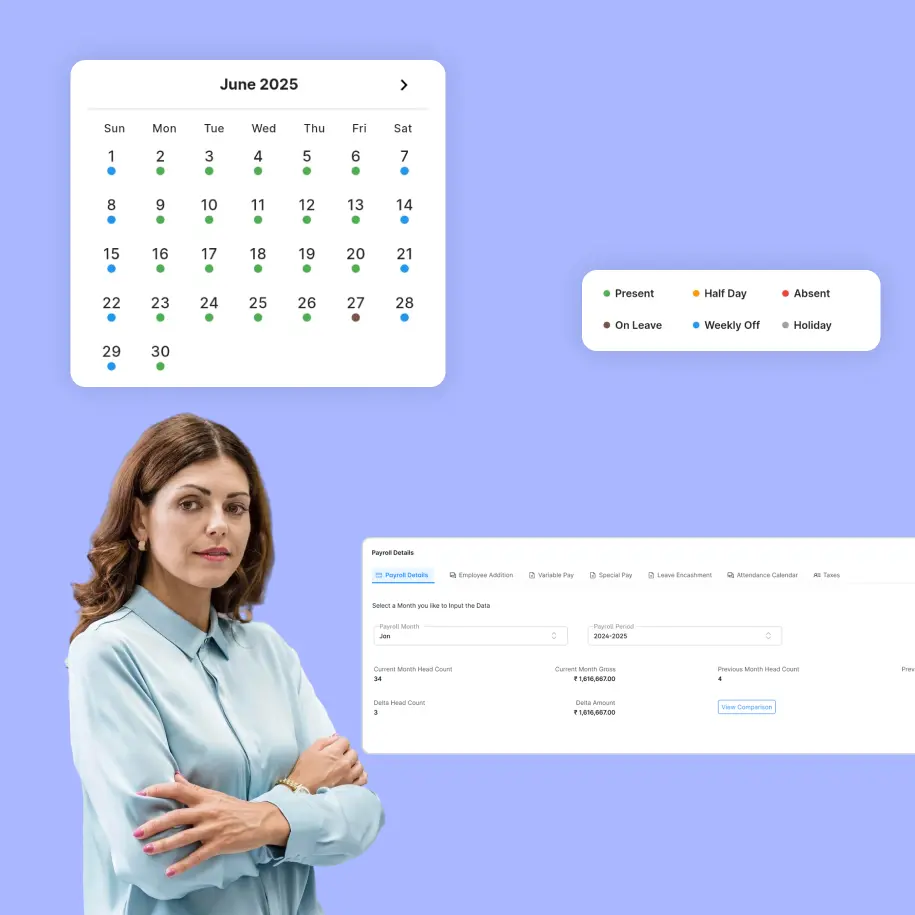

Unified Attendance, Leave & Timesheet Management

Track time, attendance, and availability accurately—fully payroll-linked.

- Multiple leave policies

- Attendance tracking & regularization

- Shift & holiday calendars

- Timesheets for projects & teams

- Payroll-ready calculations

- Geo-Fenced Tracking

Performance Management System (PMS)

Run structured reviews that drive growth—not just compliance.

- Goal & KPI setting

- Review cycles & appraisals

- Manager & self-assessments

- Performance history tracking

- Promotion & increment linkage

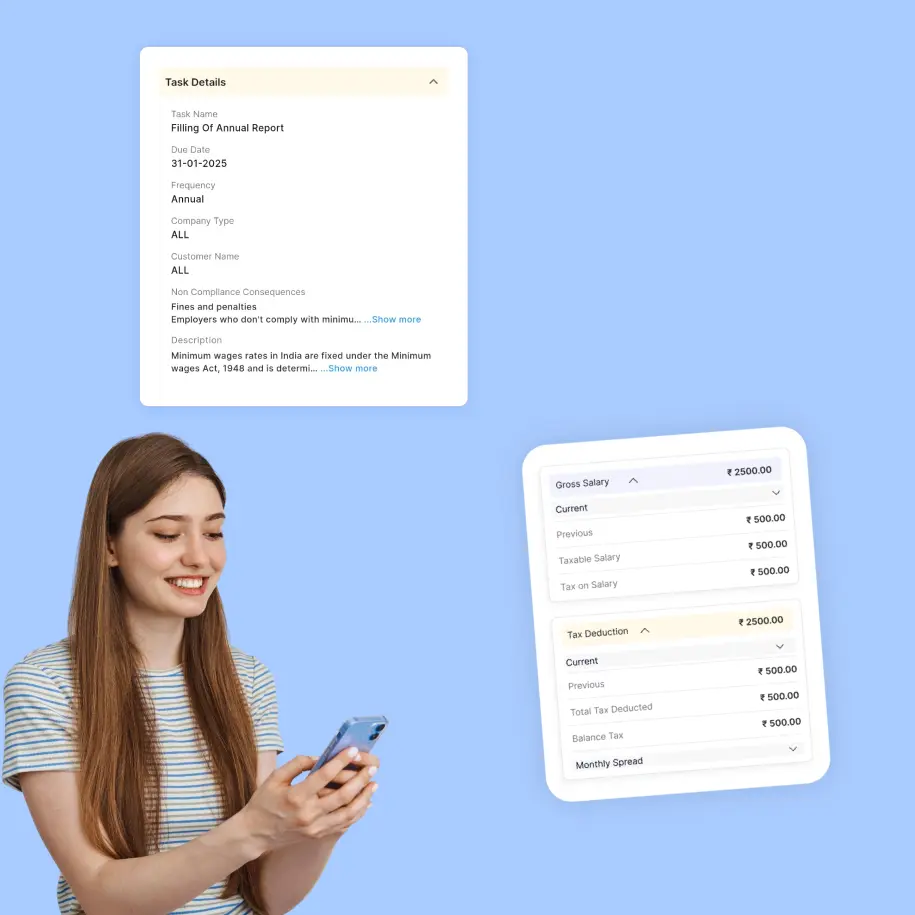

Payroll Management

Accurate, compliant payroll—run in minutes, not days.

Payroll is deeply integrated with attendance, leaves, and salary structures.

- Salary structuring & CTC management

- Automated payroll processing

- Payslips generation

- Payroll registers & reports

- Full & Final settlement

Statutory Compliance & Taxes

Stay compliant without chasing spreadsheets or consultants.

- PF, ESI, PT, TDS calculations

- Statutory deductions & reports

- Compliance-aligned payroll records

- Audit-ready data

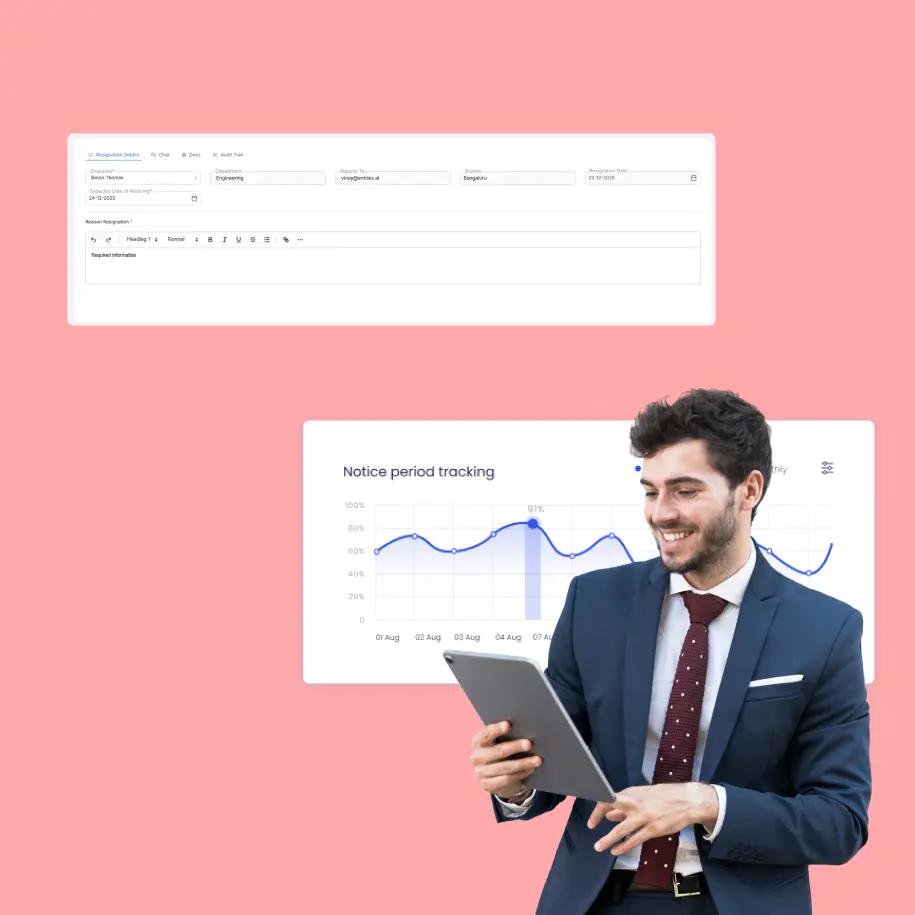

Exit Management & Full & Final Settlement

Handle employee exits professionally and compliantly.

- Resignation & approval workflows

- Notice period tracking

- Clearance & asset recovery

- Automated Full & Final calculation

- Experience & relieving letters

HR Reports & Insights

Get real-time visibility into your workforce.

- Headcount & attrition reports

- Leave & attendance analytics

- Payroll & cost insights

- Export-ready HR reports

AI-Powered HR Assistance

Let AI simplify HR operations while you focus on people.

- Smart workflow automation

- Faster onboarding & exits

- Policy & data consistency checks

- AI-driven insights for HR leaders

AI-Powered Automation Across

HR & Payroll

Workflows

Entries.ai HRMS & Payroll is built for India—statutory-ready, scalable, and simple for daily use.

Whether you're a 5-member startup or a 5000-employee company, Entries.ai grows with you.

Entries Payroll for Startups, SMEs & Growing Teams

A complete hire-to-retire system that replaces multiple HR tools.

A One system. Total visibility. Zero HR chaos.

Frequently Asked Questions.

HRMS and Payroll software helps businesses manage employee records, attendance, leave, salary processing, and statutory compliance like PF, ESI, PT, and TDS in one integrated cloud system.

Entries.ai combines HR management, payroll automation, compliance tracking, shift management, and accounting integration into a unified platform built for growing Indian businesses.

Yes. Entries.ai supports seamless HRMS migration from platforms like Keka, Greythr, HRone, Ramco and other payroll systems without losing historical employee data.

We migrate:

-

Employee master records

-

Salary structures

-

Leave balances

-

Attendance history

-

Payroll history

-

PF, ESI, PT data

-

Form 16 and statutory reports

Your historical payroll and compliance records remain intact, ensuring zero disruption and compliance continuity.

Yes. Entries.ai is a fully integrated HRMS and payroll software alternative that combines:

-

Employee Self-Service (ESS mobile app)

-

Attendance & leave management

-

Shift roster planning

-

Payroll automation

-

Compliance tracking

-

Accounting integration

-

Real-time dashboards

Unlike standalone HRMS tools, Entries.ai connects payroll directly with accounting and compliance for end-to-end control.

Yes. Entries.ai automates payroll compliance including:

-

Provident Fund (PF)

-

Employee State Insurance (ESI)

-

Professional Tax (PT)

-

TDS calculations

-

Form 16 generation

-

Statutory reports and filings

This ensures businesses remain fully compliant with Indian labor and tax regulations.

Yes. Entries.ai enables payroll processing in minutes with automated salary calculations, deductions, reimbursements, arrears, and statutory compliance reports.

Payslips are instantly available in the Employee Self-Service (ESS) mobile app, giving employees real-time access without HR dependency.

Yes. Employees get access to a mobile-first ESS app (IOS and Android) where they can:

-

Download payslips

-

Apply for leave

-

Check attendance

-

View tax declarations

-

Submit expense claims

This improves transparency and reduces HR workload.

Yes. Even if you don’t have an in-house HR or payroll team, Entries.ai can fully manage payroll operations through our dedicated support staff.

We provide:

-

End-to-end payroll processing

-

Salary calculations and payslip generation

-

PF, ESI, PT, and TDS compliance

-

Statutory filings

-

Employee query handling

This allows startups and growing businesses to run payroll without hiring additional payroll staff.

Yes. Entries.ai integrates payroll directly with accounting so that:

-

Salary expenses auto-post to books

-

TDS and statutory liabilities are recorded

-

Compliance entries reflect in real-time

-

Financial statements update automatically

This eliminates manual journal entries and improves financial accuracy.

Yes. Entries.ai supports complete attendance management, shift roster planning, and overtime calculation.

You can manage:

-

Weekly and monthly shift rosters

-

Rotational shifts

-

Night and cross-day shifts

-

Overtime policies

-

Late mark and grace rules

-

Multi-location workforce tracking

Shift schedules can be assigned department-wise or employee-wise, and payroll calculations automatically factor in attendance, overtime, and shift rules.

This makes Entries.ai ideal for manufacturing, retail, healthcare, and service companies.

Yes. Entries.ai uses secure cloud infrastructure with role-based access controls, encrypted storage, and complete audit trails to protect sensitive employee and payroll data.

HRMS implementation is as fast as 30 minutes max, and depends on company size, but migration of employee data, salary structures, compliance history, and payroll setup can be completed efficiently and quickly to ensure smooth go-live without disruption.

Yes. Entries.ai is built for:

-

VC-backed startups

-

SMEs

-

Manufacturing companies

-

Multi-location organizations

It provides structured HR workflows, automated payroll, compliance management, shift planning, and real-time workforce insights.

The best HRMS and payroll software should offer payroll automation, statutory compliance, employee self-service, attendance tracking, shift management, and accounting integration.

Entries.ai provides a unified HRMS and payroll suite designed specifically for Indian businesses seeking automation, compliance, and operational control.

Ready to modernize

your

HR & Payroll?

Get started with Entries.ai and migrate from any legacy HR or payroll system instantly—with AI-powered automation and expert support.