GST 2B Reconciliation & ITC Matching Software

Automate your GSTR-2B reconciliation, detect mismatches, track vendor compliance and ensure accurate Input Tax Credit (ITC) claims — faster and error-free.

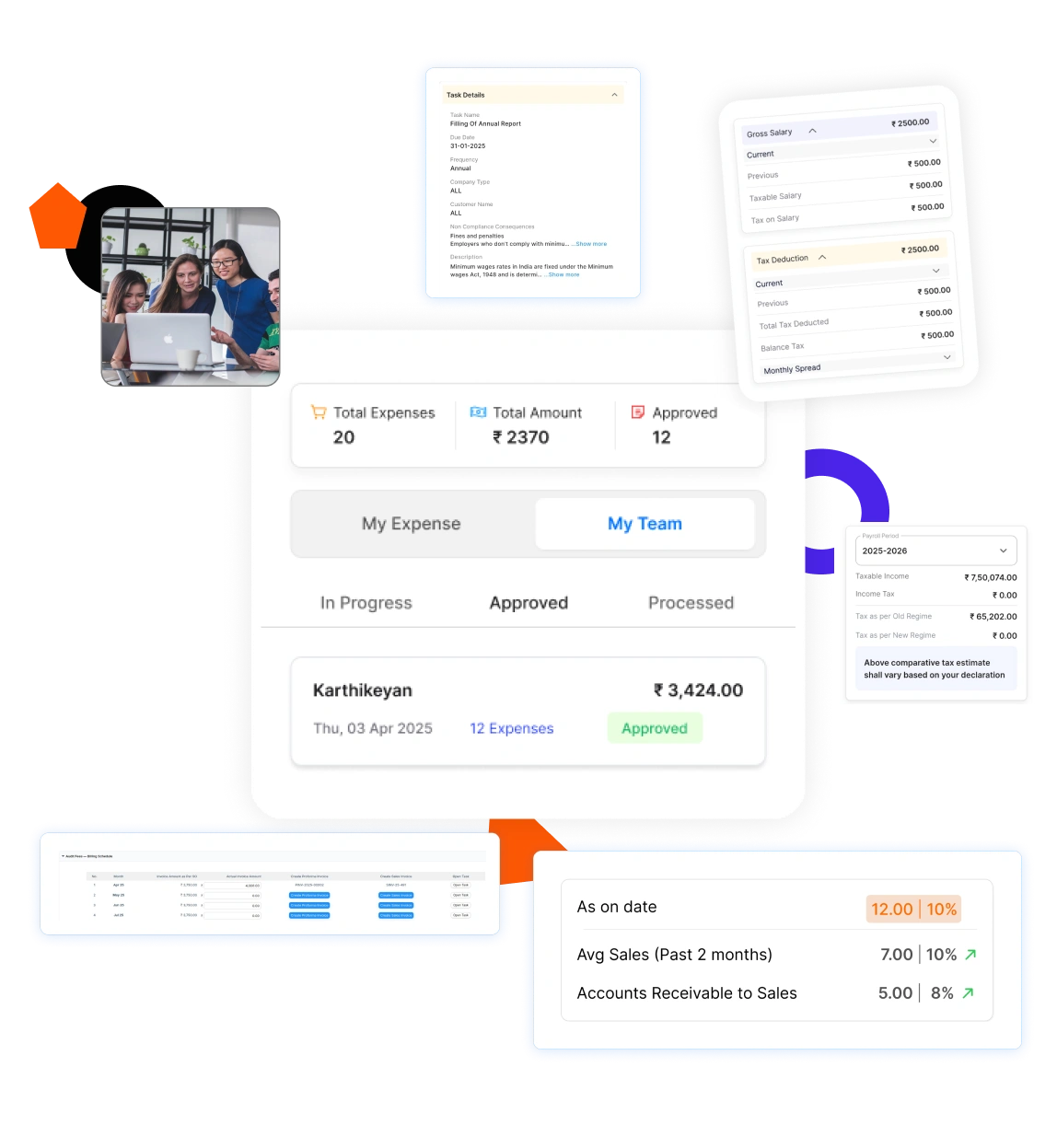

Smart, Automated 2B Reconciliation

Auto Import & Intelligent Matching Engine

Upload JSON and get instant processing.

Smart Matching Engine

Deep matching across

-

Vendor GSTIN

-

Invoice number

-

Date

-

Tax amounts

-

Item values

Mismatch Detection

See exactly where things differ

-

Qty/Rate mismatch

-

Missing invoices

-

Extra invoices

-

Vendor mismatch

-

Amendments

Vendor Compliance Tracking

Assess your vendor's GST behavior.

-

Compliance score

-

Pending documents

-

Repeated mismatches

-

Monthly summaries

Automated ITC Posting to Accounts

Finalized credits move automatically to your books.

Integration with GST Filing Workflows

Inventory transactions flow directly into GST returns, ensuring accurate tax reporting and seamless compliance.

-

Auto GST calculation on sales & purchases

-

Direct integration with GSTR-1 & GSTR-3B

-

GSTR-2B ITC reconciliation support

-

HSN/SAC code mapping at item level

-

Real-time GST liability tracking

Frequently Asked Questions.

GSTR-2B reconciliation is the process of matching your purchase invoices with the auto-generated GSTR-2B statement available on the GST portal. It ensures that Input Tax Credit (ITC) claimed in your GST returns is accurate and compliant. Without proper GST 2B reconciliation, businesses risk ITC mismatches, notices, and penalties.

Entries.ai automatically imports your GSTR-2B data, matches it with purchase invoices in your accounting system, identifies mismatches, and highlights missing invoices. The system reduces manual Excel reconciliation and ensures accurate ITC claims through intelligent GST matching algorithms.

GSTR-2A is a dynamic statement that changes based on supplier filings, while GSTR-2B is a static monthly statement used for ITC calculation. Businesses must perform GSTR-2B reconciliation before filing GSTR-3B to ensure correct ITC claims.

Yes. Automated GST 2B reconciliation software detects mismatches between supplier invoices and purchase records. It flags:

-

Missing invoices

-

GSTIN mismatches

-

Invoice number differences

-

Tax amount variances

This ensures accurate Input Tax Credit (ITC) claims and reduces GST compliance risks.

The Invoice Management System (IMS) under GST allows businesses to accept, reject, or mark invoices before ITC is claimed. IMS works alongside GSTR-2B reconciliation by improving invoice visibility and vendor compliance tracking.

Yes. Entries.ai provides vendor compliance tracking, helping businesses identify suppliers who have not filed GSTR-1 or whose invoices are missing from GSTR-2B. This improves ITC accuracy and strengthens GST audit readiness.

While not legally termed “mandatory,” GSTR-2B reconciliation is essential to claim correct ITC under GST law. Incorrect ITC claims can result in notices, penalties, or interest liability. Regular reconciliation ensures compliance and audit readiness.

Yes. Manual reconciliation using Excel is time-consuming and error-prone. A cloud-based GST 2B reconciliation software like Entries.ai automates matching, reporting, and ITC validation, saving time and reducing compliance risk.

Yes. Entries.ai integrates GST 2B reconciliation directly with accounting workflows, ensuring matched ITC entries flow automatically into books. This enables real-time financial visibility and GST-compliant reporting.

Businesses should perform monthly GSTR-2B reconciliation before filing GSTR-3B returns. High-volume businesses may benefit from weekly reconciliation to minimize mismatches and improve vendor follow-ups.

Reconcile Faster. Claim Correctly. Avoid Loss of ITC.

Simplify reconciliation, automate reporting, and ensure 100% accuracy through our input tax credit automation workflows—all with one intelligent, integrated app